ALS delivers 14.7% underlying EBIT growth and margin uplift, supported by strong Commodities performance and improved Life Sciences

FY26 highlights1

- Underlying revenue of $1.7 billion, an increase of 13.3% led by strong organic growth within Commodities contrasting softer growth conditions within Life Sciences

- Underlying EBIT2 of $287.2 million, an increase of 14.7%, with underlying EBIT margin strengthening by 20 bps to 17.3%

- Underlying NPAT of $178.4 million, increasing 17.2%

- Statutory NPAT of $141.7 million, increasing 11.8%

- Commodities strong with the Minerals margin resilient at 31.3%; strong organic revenue growth reflecting increased sample volumes and revenue mix benefit offset by drag through of Q2 and Q3 FY25 discounted pricing

- Life Sciences led by strong Food results with Environmental growth maintained in key markets. Nuvisan performing in line with expectations

- Strong balance sheet reflecting reduced net debt position following the equity raise in May 2025. Organic hub lab expansion projects remain on track with $67.7 million spent in H1 FY26. Available liquidity of >$550 million and EBITDA cash conversion of 88%3

- Interim dividend of 19.4 cps (30% partially franked), representing a payment of $98.4 million to shareholders

- Continued improvement to safety performance rates; lowest-ever recorded levels for ALS4

H1 FY26 financial results

| A$ million | H1 FY26 | H1 FY25 | Change | H1 FY26 at CCY | CCY change |

| Underlying revenue | 1,659.6 | 1,464.2 | 13.3% | 1,598.0 | 9.1% |

| Underlying EBIT | 287.2 | 250.4 | 14.7% | 278.4 | 11.2% |

| Margin | 17.3% | 17.1% | +20 bps | 17.4% | +32 bps |

| Underlying NPAT | 178.4 | 152.3 | 17.2% | ||

| Statutory NPAT | 141.7 | 126.8 | 11.8% | ||

| Basic EPS (cents per share)5 | 35.7 | 31.4 | 13.7% | ||

| Free cash flow generated | 303.9 | 274.3 | 10.8% | ||

| Underlying ROCE | 19.4% | 19.4% | (8) bps | ||

| DPS (cents per share) | 19.4 cps | 18.9 cps | 2.6% | ||

| Net debt | 1,150.6 | 1,382.7 | (16.8)% |

ALS Chairman, Nigel Garrard, commented, “The Group has delivered a strong first half result with organic revenue growth recorded across all business streams, resilient margins, and both underlying earnings and profit considerably up. Reflecting the continued progress and strength of the Company, the Board is pleased to declare an interim dividend of 19.4 cents per share, an increase of approximately 3%”.

CEO and Managing Director, Malcolm Deane, commented, “Amid ongoing geopolitical and macro uncertainty, the Group had a strong first half driven by strength in Commodities contrasting lower growth conditions for Life Sciences.

Within Commodities, the businesses delivered a strong performance, achieving 14.3% (12.0% in constant currency) organic revenue growth supported by favourable market conditions. Growth was recorded across all regions. Within Minerals, activity continues to be led by major and mid-tier miners, while improving funding conditions for junior explorers are contributing to higher quotation and early-stage project activity. Despite the impact of price discounting from FY25, Minerals maintained a resilient margin above 31%, reflecting the benefits of operating leverage and disciplined cost management. Looking ahead, the pricing environment within Geochemistry is expected to improve through the second half of FY26, positioning ALS to benefit from any sustained uplift in mineral exploration activity.

Life Sciences performance was slightly below expectations and was led by a strong Food result. Environmental delivered solid organic growth in our key market geographies of APAC and EMEA, whereas some market-specific challenges within LATAM and the York business in the US dragged on overall performance. Pharmaceutical was impacted by a regulatory change in Mexico but at the lower end of estimates, whilst Nuvisan pleasingly delivered improved organic revenue growth and stronger margins.

These results demonstrate ALS’ ability to create value as a diversified global testing business. Our disciplined capital deployment following the May equity raise is progressing according to plan, accelerating key capacity expansion projects while maintaining balance sheet strength. Combined with double-digit EPS growth, strong cash generation, and a healthy pipeline of demand, ALS is well positioned to deliver another year of growth and continue building long-term shareholder value.”

Divisional review

Commodities

| A$ million | H1 FY26 | H1 FY25 | Change | H1 FY26 at CCY | CCY change |

| Revenue | 612.3 | 535.7 | 14.3% | 599.9 | 12.0% |

| Underlying EBITDA | 211.4 | 185.1 | 14.2% | 206.8 | 11.7% |

| Margin | 34.5% | 34.5% | +2 bps | 34.5% | (8) bps |

| Underlying EBIT | 171.8 | 150.9 | 13.9% | 168.9 | 11.9% |

| Margin | 28.1% | 28.2% | (11) bps | 28.2% |

(2) bps

|

Revenue grew 14.3% vs pcp with organic revenue growth of 12.0% and a favourable currency impact of 2.3%. Overall YoY sample flow volumes saw a low double-digit increase to end of H1 FY26, benefiting traditional exploration testing revenue.

Underlying EBIT increased by 13.9% to $171.8 million, with the overall margin resilient at 28.1%. Underlying margins continue to be resilient reflecting leverage and flexibility of the cost base offsetting FY25 price discounting flowing through.

Minerals organic revenue increased by 11.8% with the EBIT margin improving by 11 basis points to 31.3%. Geochemistry organic revenue grew by 14.0% largely through improved sample volumes from exploration testing, continued take-up of High Performance Methods (HPMs) and mine site production testing. Metallurgy revenue and margin declined due to lower volumes and a higher proportion of brownfield work.

After 22 successful years with ALS, Bruce McDonald, Minerals EGM, has announced he will be retiring at the end of March 2026. Bruce will continue to be available for a period post his retirement to ensure a smooth transition to his successor and to support projects at the direction of the CEO. A comprehensive global search assessing both internal and external candidates is underway.

Industrial Materials delivered strong organic revenue growth of 12.2% although margins were compressed across the Coal (mix and sale and leaseback) and Oil & Lubricants segments (isolated volume and efficiency issues).

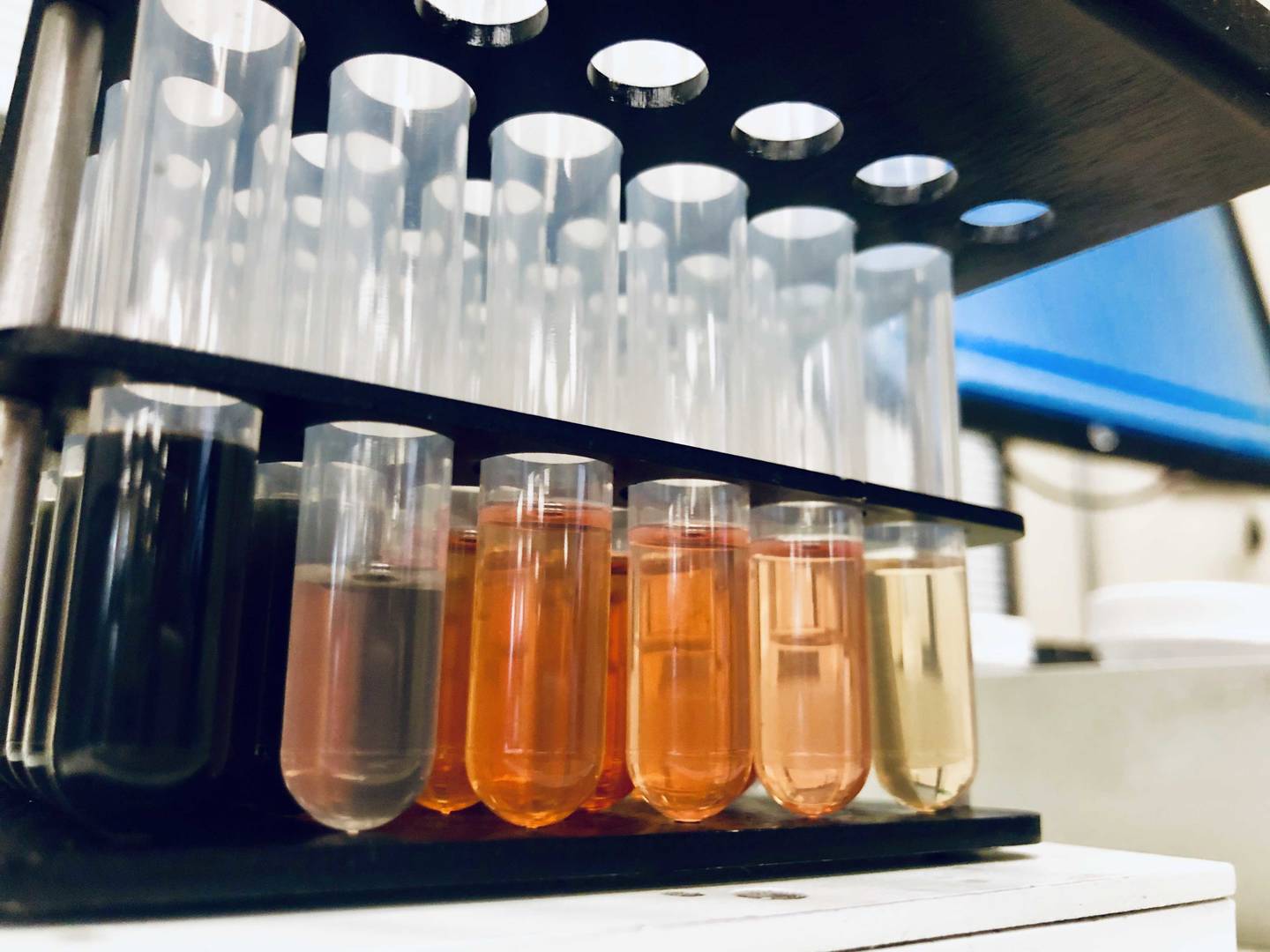

Life Sciences

| A$ million | H1 FY26 | H1 FY25 | Change | H1 FY26 at CCY | CCY change |

| Revenue | 1,047.3 | 928.5 | 12.8% | 998.1 | 7.5% |

| Underlying EBITDA | 234.6 | 200.7 | 16.9% | 223.5 | 11.4% |

| Margin | 22.4% | 21.6% | +79 bps | 22.4% | +78 bps |

| Underlying EBIT | 158.6 | 133.7 | 18.6% | 151.0 | 12.9% |

| Margin | 15.1% | 14.4% | +74 bps | 15.1% | +72 bps |

Revenue increased by 12.8% with organic revenue growth of 4.0%, favourable currency impact of 5.3% and scope growth of 3.5%. Organic growth was led by a strong performance from the Food business (7.0%), with slower positive organic growth in both the Environmental (4.0%) and Pharmaceutical (0.9%) businesses.

Underlying EBIT increased by 18.6% to $158.6 million with the overall margin increasing to 15.1%. Excluding the impact of Nuvisan, York and Wessling acquisitions, the margin was 17.7%.

Environmental delivered organic revenue growth of 4.0% with growth in key markets of EMEA and APAC dragged by slower performance in the Americas. Organic growth in PFAS testing continued to substantially outpace the broader Environmental organic growth rate, with PFAS revenue representing ~6% of broader Environmental revenue. The integration of Wessling continues to track well with revenue and earnings exceeding expectations while York faced business-specific challenges which are now being rectified.

Subsequent to balance date, as part of the Wessling integration program, an agreement to divest the Wessling consulting engineering business was signed on 31 October, with completion expected by end November.

Food organic revenue grew by 7.0% supported by volume and price growth primarily in EMEA, APAC and LATAM.

Pharmaceutical organic revenue increased by 0.9%. Performance was impacted by the Mexican regulation change decreasing demand of local testing requirements for imported drugs, although to date the impact on EBIT has been managed towards the lower end of the estimated full year impact range of $5 million-$10 million. Nuvisan performance reflected successful transformation benefits with positive revenue growth and substantial margin improvement vs pcp (+475 bps).

Capital management, growth and balance sheet

The Group has a disciplined approach to capital management and continues to deliver on the key objectives of the ALS value creation framework; growth, strong cash generation, shareholder returns and balance sheet strength.

Core capital expenditure (excluding acquisitions) was $89.1 million representing 145% of depreciation and 5.4% of revenue (3.6% growth-related and 1.8% maintenance spend).

In addition, under the hub lab expansion program, which is on track, a total of $67.7 million was invested into key hub laboratories across Minerals (Lima, Peru) and Environmental (Sydney, Australia; Bangkok, Thailand; and Prague, Czech Republic). The total capital expenditure relating to the hub lab expansion is expected to be ~$230 million across five years.

The Group’s leverage ratio decreased to 1.8x which is towards the lower end of the targeted range (1.7x – 2.3x), reflecting the reduced debt position post the equity raise in May 2025. Both the leverage ratio and the EBITDA interest cover ratio of 10.2x are well within lender covenants. The Group’s weighted average debt maturity is 4.4 years.

The Group continues to assess a number of M&A bolt-on opportunities in key end-markets.

As at 30 September 2025, Group liquidity was >$550 million. EBITDA cash conversion for the half was 88%.

The underlying net interest expense in H1 FY26 was $37.6 million, a decrease of $3.4 million from H1 FY25, largely reflecting the Group’s reduced debt position. The Group’s drawn debt profile consists of 83% fixed at 3.7% and 17.0% floating rate debt at 4.3% as at 30 September 2025, with a total weighted average cost of drawn debt at 3.8%.

The Group will continue to focus on strong cash generation in the next 24 months.

Interim dividend

Reflecting the strong H1 FY26 result, the Directors have declared an interim dividend of 19.4 cents per share (cps), partially franked to 30% (H1 FY25 interim dividend: 18.9 cps, partially franked to 30%). This represents a dividend increase of 2.6% vs pcp and a payout ratio of 55% of H1 FY26 underlying NPAT.

The dividend will be paid on 17 December 2025 to shareholders on the register at 27 November 2025.

The Dividend Reinvestment Plan (DRP) will recommence for the H1 FY26 interim dividend at a nil discount.

Link to DRP plan rules: www.alsglobal.com/en/corporate-governance

Relocation of headquarters

In July 2025, the operational headquarters were relocated from Houston, Texas, to Europe, where close to 40% of the workforce is based. As part of this relocation, the CEO and Managing Director, Malcolm Deane, and the CFO, Stuart Hutton, both relocated to Madrid, Spain.

Perspectives for FY26 and beyond

ALS remains focused on delivering top-tier services to customers consistently, safely and reliably.

The Group is on track to deliver 6-8% (revised up from 5-7%) organic revenue growth and steady margin improvement in FY26. The phasing of underlying NPAT earnings is expected to be similar to FY25 – approximately 48% in H1 and 52% in H2.

In Commodities, the Group anticipates 12-14% (revised up from 5-7%) organic revenue growth in FY26. The unwinding of legacy price discounting and a more favourable pricing environment linked to positive sample volume trends experienced in H1 FY26, is expected to flow through H2 FY26, with incremental margin expansion of 100-125 bps as compared to H1 FY26. It is expected that Metallurgy performance will benefit as its revenue outlook improves. Industrial Materials is expected to see continuing growth in Oil & Lubricants and Assay & Inspection.

In Life Sciences, the Group anticipates 4-6% (revised down from 5-7%) organic revenue growth in FY26. The expectation is that there will be solid growth in key Environmental geographies with more subdued performance in the Americas. Food and Pharma business units to continue organic growth aligned to reported H1 levels. The Group is targeting continued margin improvement within Life Sciences legacy operations6 of between 20-40 bps in FY26.

Capital allocation and minimum ROCE targets will continue in line with the value creation framework.

The Group remains well on track to execute on its strategy and meet the FY27 financial targets including growing revenue to $3.3 billion and growing underlying EBIT to $600 million, with a Group EBIT margin floor of 19%7.

Treatment of one-off costs to change

In H2 FY26 the underlying methodology will change to simplify the treatment of one-off costs (reclassify greenfield and restructuring costs as part of the underlying measure). For FY26 these are expected to be in the range of $6-$8m at the NPAT line (H1 FY26 $4.8m). Refer slide 33 for restated comparatives.

Michael Williams

Group Treasurer, Investor Relations & Business Integration Director

michael.williams@alsglobal.com

M: + 61 409 001 308

Investor Relations

investor@alsglobal.com

ALS Limited

Media enquiries

media@alsglobal.com

ALS Limited

About ALS Limited (ASX: ALQ)

ALS is a global leader in testing, providing comprehensive testing solutions to clients in a wide range of industries around the world. Using state-of-the-art technologies and innovative methodologies, our dedicated international teams deliver the highest-quality testing services and personalised solutions supported by local expertise. We help our clients leverage the power of data-driven insights for a safer and healthier world.

1 All financial results compared to the prior comparable period of H1 FY25 unless otherwise noted. Numbers may not add up due to rounding.

2 Underlying profit measures are a non-IFRS disclosure and exclude unusual events and non-recurring items including acquisition-related and greenfield start-up costs, impairment and fair value gains/(losses), amortisation of separately recognised intangibles, SaaS system development costs, and other business restructuring and site closure costs.

3 EBITDA cash conversion calculated as cash flow before capex divided by Underlying EBITDA (adjusted for ROU lease assets).

4 TRIFR = 0.82 and LTIFR = 0.15 as at 30 September 2025. Calculated on a 12-month rolling average per million hours worked.

5 Basic EPS calculated as: Underlying NPAT / weighted average number of shares.

6 Excluding Nuvisan, Wessling and York.

7 Excluding the impact of acquisitions.